HMO licensing is causing quite a stir, but why is it so important?

HMO licensing has affected so many landlords up and down the country. Updates to the legislation mean that a further 170,000 are to be affected by licensing laws by the end of the year. I assume many of you may be asking, or have asked at one point, why do we need HMO regulation?

To put it simply, the need for HMO licensing is directly linked to the increase in the private rented sector. In 2014, the Smith Institute revealed that the private rental market now extends to include 20% of the entire housing market. So with more people involved in private property rentals, the market becomes harder to regulate and standards difficult to uphold.

The growth of the private housing can be reduced to three main causes. Most significantly, and certainly well talked about currently, is the decline of home ownership. There is a reason millennials have been graced with the title ‘generation rent’. Nowhere is that truer than in our fantastic capital. In London, home ownership is down to just 50%. Overall, for those aged 25-30 home ownership has dropped by nearly a quarter. Secondly, the continued growth of the buy to let market, which has seen greater numbers of ‘retirement fund landlords’ introduced to the market. Finally, the provision of social housing has been slowing down to an almost complete halt since the 1980s.

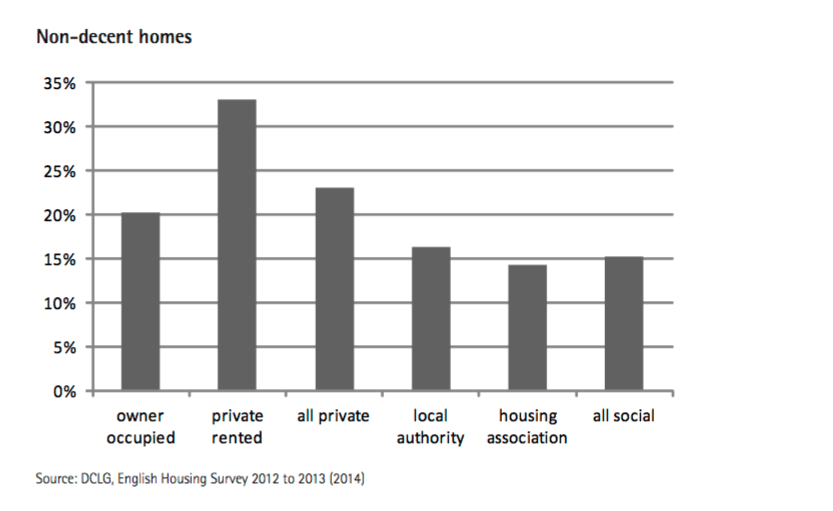

For enterprising individuals, the growth of the private rented sector is no bad thing, as greater demand equals greater supply – along with fantastic business opportunities. The problem arises when the growth of the market stretches to include landlords who do not follow good standards and practices – giving the rest a bad name! The table, at the top of this article, is taken from a paper published by the Department for Towns and Local Governments. It shows, quite clearly, that the number of non-decent homes is significantly greater in the private rented sector. Though it must be noted – the recent housing white paper claims that this percentage has actually fallen to 28%.

These bad landlords have received a lot of press over recent years, the BBC series Housing Enforcers and CH4’s Landlords from Hell series are just the tip of the ice-burg. A lot of this bad press has been deserved, I worked with tenants who were living in conditions you wouldn’t keep a small pig in. A report by Shelter, published in 2016, determined that London has the worst private landlords of the nation. With one out of five renters in London claiming to have been victimised by landlords failing to meet industry standards.

However, I have also had wonderful landlords, the kind that come round every Monday to test the fire alarms and have a quick chat or tell you you’re getting a new boiler before you’ve even noticed a problem with the old one.

The bad landlords need to be deterred from the market full stop and that is what recent movements have been focused on doing. Government legislation has sought to tighten up rules in the market, from the use of third party agencies for deposits to the recent changes to HMO licensing. The message is clear, the private rented sector is going to be more scrutinized than ever before and hence more regulated than ever before.